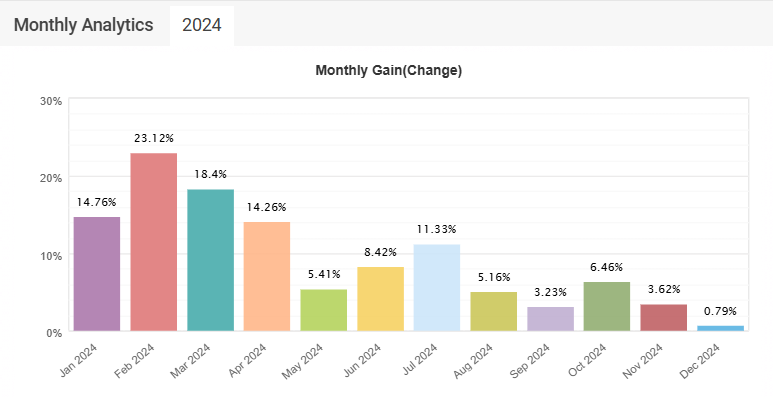

Day Trading EA Performance

Day Trading has concluded the week with a performance of 0.79%. While this return is lower than our usual weekly averages, it is important to note that this week has been relatively muted, despite the significant political and economic news that has been released into the market. Our well-crafted strategy, however, continues to demonstrate its ability to add value even amidst these subdued EUR/USD movements. This consistent performance further proves that our trading strategy possesses a distinct edge, allowing us to navigate varying market conditions with confidence.

Bitcoin breaks $100,000!

Bitcoin looks to be stabilizing Friday after a sudden 7% fall early in the Asian session, with volatility in the token reviving after its run past $100,000. The selloff signals the cryptocurrency may have reached a short-term top to set off some profit-taking, but the bull run may resume with many investors touting the potential for President-elect Trump to deliver on promises to the sector.

Some may decide to wait to see a regulatory push to make crypto more mainstream in the US once the new government takes over in January.

The digital asset fell as low as $92,144 on Friday, leading to liquidation of $816m of leveraged long positions, the most in at least the past 2 months, according to Coinglass.

Bitcoin has rallied more than 50% since Trump’s election victory and it breached the round figure milestone of $100,000 on Thursday after the President-elect appointed digital-asset proponent Paul Atkins as the new head of the US securities regulator.

Oil looks for direction – heading south for now

OPEC+ AGREES TO DELAY OIL-OUTPUT HIKE BY 3 MONTHS

Brent lower this week but need to see directional movement of impact

US Equity Markets

S&P 500 on track for +25% returns 2Y running for only 6th time since 1870.

The S&P 500 is on track to rise +25% for the second year in a row for only the 6th time since the 1870s – subsequent years have generally seen large moves in either direction… the SPX still remains way down on 2000 levels when measured in gold terms

Technical Analysis: EURUSD

EURUSD 240min graph: 1.0750 against all odds?