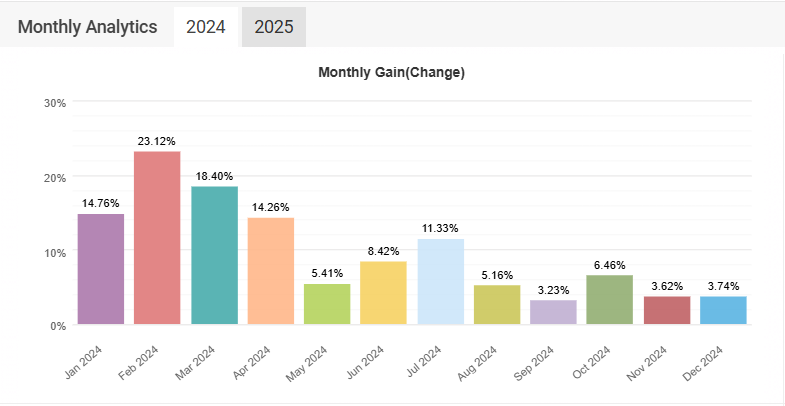

Day Trading EA Performance

Our Day Trading strategy achieved an impressive 201% return for 2024 (time weighted return), showcasing its potential for high profitability in the forex market. Our strategy involves making multiple trades within a single day to capitalize on short-term price movements, specifically on EURUSD. By leveraging technical analysis and real-time market data, Day Trading aims to exploit intraday volatility and secure gains via its automated trading. The success of this strategy hinges on disciplined risk management, quick decision-making, and a deep understanding of markets.

Milestone

Surpassing 200,000 euros in assets under management (AUM) was a significant milestone for the Day Trading team! This achievement reflects the trust and confidence that investors have placed in our management capabilities and strategy. It also indicates that our fund has been successful in generating returns and managing risks effectively, attracting more capital over time.

With this growth in AUM, it’s crucial to continue focusing on maintaining performance, ensuring robust risk management practices, and transparent communication with our investors. This will help sustain and potentially increase investor confidence, leading to further growth and success!

Despite its high returns, Day Trading is not without risks. It requires a significant commitment of time, attention, and capital. Our team remains vigilant and adaptable to market fluctuations, as well as maintain a strict adherence to their trading plan to mitigate potential losses. The 201% return underscores the effectiveness of the Day Trading strategy when executed with precision and discipline, making it an attractive option for experienced and new traders seeking substantial gains in the forex markets.

Starting off 2025 with a 0.44% weekly return, Day Trading has set a solid beginning, especially considering the market’s subdued volatility and lack of major financial hubs due to the festive period. This return indicates a steady, albeit modest growth, which can be a good sign for maintaining a consistent trading strategy. It’s important to keep an eye on market trends and economic indicators to sustain and potentially improve this performance as the year progresses.

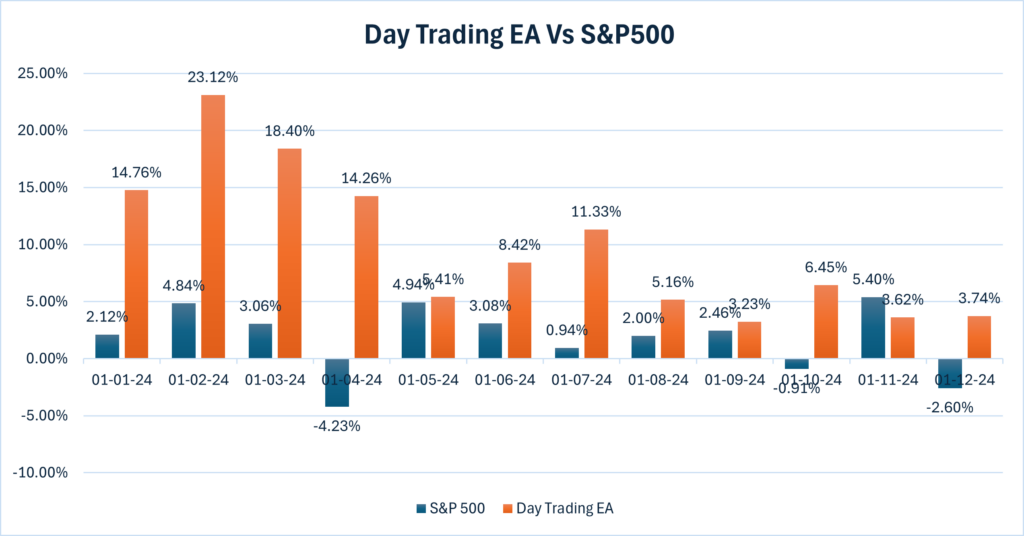

Day Trading Vs S&P 500 Performance

We benchmark ourselves against the S&P500, and in 2024, Day Trading’s strategy in forex yielded an impressive 201% return, significantly outperforming the S&P 500 which returned 25.66% with dividend reinvestment. Day Trading’s strategy high return, highlights its potential for substantial gains through short-term, intraday trades, leveraging market volatility and quick decision-making. On the other hand, the S&P 500, a benchmark for U.S. equities, offers a more stable and diversified investment, reflecting the overall performance of 500 large companies listed on stock exchanges in the United States.

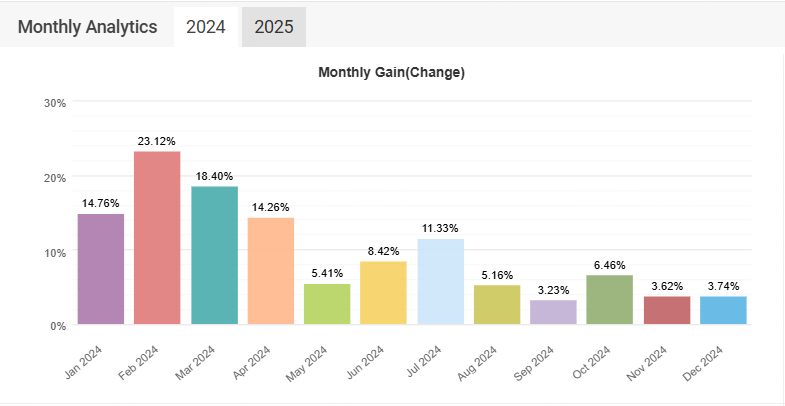

2025 Day Trading EA Strategy

Following a successful 2024 year, our managing director has endorsed a new risk/return strategy. Specifically, reducing the potential return to a more conservative range of 3-5% monthly is a prudent move to manage risk. This approach allows us to maintain more stable gains while minimizing exposure to the high volatility and rapid changes inherent in trading. It reflects a balanced strategy that seeks consistent growth without taking on unnecessary risk.

With this more controlled risk profile, it’s important to stay disciplined in our trading plan and regularly review your performance against investor goals. Adapting to market conditions and making adjustments as needed can help ensure that we continue to achieve steady returns. It’s also crucial to keep learning and refining our strategy to stay ahead in the dynamic forex market, and allow our investors to grow financially.

The Day Trading Team

Great results and happy to be part of this great team!

Many thanks for your kind words and trust in our Day Trading System!