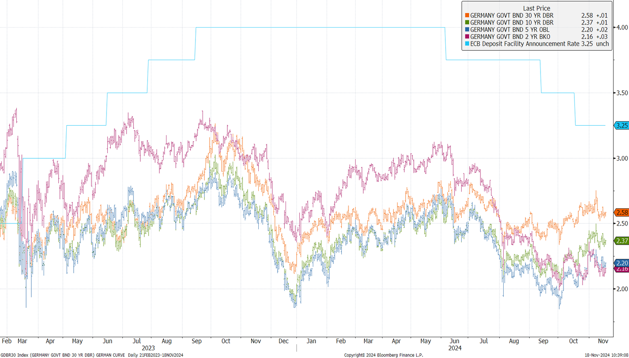

A BIG week for {EU} Europe {EU} this week with the release of the flash PMIs on Friday. It goes without saying that this is Europe’s single most important data release and of course highly relevant for the ECB. The survey WILL COVER THE POST ELECTION SHOCK so it will be the first read of how sentiment is being impacted by the Trump victory. Specifically for Germany, it will (to a significant extent) also cover the early election news. Consensus expectations are strangely looking for a small rise in both the French and German numbers which seems a bit ambitious given the sharp downside to the ZEW we saw a few days ago. Let’s see where things land, but the bottom line is if we get a sizeable (1point+ drop) a 50bps from the ECB in December should become the baseline. Of course, it goes without saying that the risks to all the {US} US survey data {US} coming up are tilted to the upside as per the Empire Survey today. The risk distribution around upcoming potential data releases is in my view one reason why any dollar short squeezes are likely to be limited. In the big scheme of things, continue to believe the market should be pricing ECB terminal of 1.5% or below and Fed terminal of 4% and above. It makes no sense to be pricing in an easing cycle when the economy is ALREADY growing above trend, inflation is above target and there are more positive growth/inflation shocks to come.

A BIG week for Europe

- Post author:The Day Trading team

- Post published:November 21, 2024

- Post category:Blog

- Post comments:0 Comments