Bottom line:

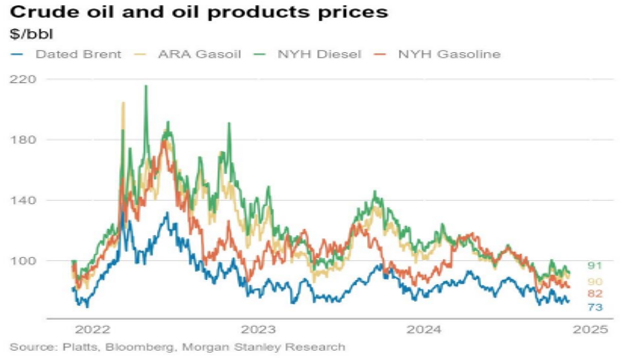

• Oil market is broadly balanced in 4Q, but on current trends, a meaningful surplus lies ahead in 2024

• To aid the rebalancing of the oil market, we suspect Brent prices will need to fall into the $60s for a period

Key drivers:

• Oil demand to grow ~0.8 mb/d in 2024, lower than expected earlier in the year, with China the main source of downwards revisions. Expect a modest re-acceleration to 1.0 mb/d in 2025.

• Non-OPEC supply set to grow at a brisk pace in 2025. Although US production growth slows, several other supply sources still drive total non-OPEC growth to 1.6 mb/d, in turn reducing the call-on-OPEC

• Following two delays to the planned unwinding of production cuts already, we now estimate OPEC crude supply will grow only 0.4 mb/d y/y in 2025

• Still, this leaves the oil market ~1.3 mb/d oversupplied, we estimate, which is historically rare. Whilst this is our ‘best estimate’ now, the market needs to rebalance to prevent this outcome from materialising

• The US election outcome has the potential to impact oil markets over time. For now, however, possible impacts point in opposite directions, making this hard to call. At the upcoming meeting on 1 Dec, our assumption is that OPEC+ leaves the output agreement unchanged.